Scams: Love, Lies, and Billions Lost

Written by: Janine Daniels-Moore, Victim Services Coordinator

Have you, or someone you know, been a victim of a scam?

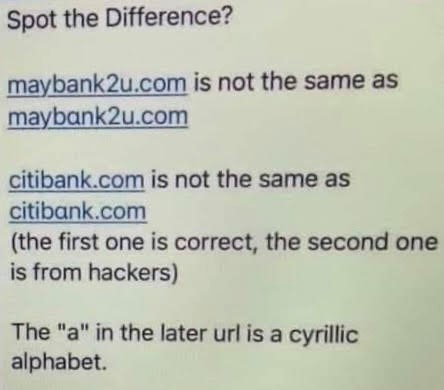

CAN YOU SPOT THE DIFFERENCE?

As financial technology protections become more sophisticated, so are fraudsters’ methods to scam you out of your money. Scams can wreck their victims’ finances, credit scores, emotions, and so much more. Scammers are like viruses: They continually evolve in response to the latest news and trends, using them for new ways to separate us from our cash. According to Amy Nofziger, director of fraud victim support for AARP, “these criminals are so adaptable, they’re going to just follow the headlines”. As she and other anti-fraud experts note, scammers have proved ingenious when it comes to updating traditional criminal operations such as the romance scam or the Ponzi scheme with new twists to make them more convincing and effective.

And like the rest of society, scammers are increasingly going online. “Most con artists have taken a digital-first approach to scamming,” says Josh Planos, Vice President of Communications and public relations for the Better Business Burearu (BBB). He notes that the vast majority of today’s scams originate through a digital on-ramp, such as social media or email. In 2022, Americans reportedly lost almost $40 BILLION dollars to phone scams alone.

Let’s take a look at romance scams. According to the FTC, in 2022, nearly 70,000 people reported a romance scam, and reported losses hit a staggering $1.3 billion. The median reported loss: $4,400. The FBI anticipates a higher reported financial loss due to a trend in International Crypto Investment Fraud as part of romance scams. The scam starts similarly as an online relationship, but instead of asking for cash, the scammer convinces the victim to investment in cryptocurrency.

So, how can we as a society avoid being scammed? Knowing what to watch out for is a key ingredient to protecting ourselves. Let’s take a look at three popular scams and how we can protect ourselves from them:

- Charitable donations scam

- To get their hands on your money, scammers will stoop to any low, including exploiting your empathy. This kind of scam can take the form of phishing, where a website or email letter looks like it’s from a legitimate organization. More often, however, a scammer will use social engineering and approach you over the phone or in person to play on your emotions.

- WHAT YOU CAN DO: Make sure to research any organization before donation and look for the Employee Identification Number (EIN) on the nonprofit’s website to ensure the money is going to the right place.

- Gift card scams

- According to a survey from AARP, 26% of U.S. consumers received a gift card with no funds on it. What gives? There are a couple of ways scammers can drain a gift card’s balance before you use it. They might, for instance, take cards off the store rack, tamper with the protective strips and steal the bar codes. The fraudster buys similar security tape and replaces the strips to make the card look untouched. Then they enter the card’s code into a program that tracks the retailer’s website and informs the scammer when someone buys the card so they can spend the money on it or cash it. As a result, by the time the card makes it to its recipient, it’s a worthless piece of plastic. Other fraudsters advertise gift card exchange websites or sites that offer to check your gift card balance. You’re prompted to input your gift card information, which the scammer then uses to drain the card’s balance.

- WHAT YOU CAN DO: When buying a gift card, take a close look at it to ensure it hasn’t been tampered with — and only buy from reputable reseller.

- Romance scams

- This type of scam can not only leave you in financial ruin, but also heartbroken. The criminal meets you on a dating or social media app, sweeps you off your feet and tries to get into a relationship with you-sometimes for the long haul, as they will try and groom their victim. One common sign of a romance scammer is that they probably live far away and make plans to meet you in person-but never will. Instead, they’ll ask you for money to pay for unexpected medical bills or to get them out of trouble. Usually, they’ll instruct you to wire money or put it on a gift card. They might be asking you for money repeatedly until you stop sending it, at which point the love of your online life will disappear. Victims of romance scams often find themselves in debt, legal trouble and with serious trust issues.

- WHAT YOU CAN DO: Be careful what you post and make public online. Scammers can use details shared on social media and dating sites to better understand and target you. Research the person’s photo and profile using online searches to see if the image, name, or details have been used elsewhere. Go slowly and ask lots of questions. Beware if the individual seems too perfect or quickly asks you to leave a dating service or social media site to communicate directly. Beware if the individual attempts to isolate you from friends and family or requests inappropriate photos or financial information that could later be used to extort you. Beware if the individual promises to meet in person but then always comes up with an excuse why he or she can’t. If you haven’t met the person after a few months, for whatever reason, you have good reason to be suspicious. Never send money to anyone you have only communicated with online or by phone.

If you suspect your online relationship is a scam, cease all contact immediately and report the incident to your financial institution and the FBI at www.ic3.gov. Filing a complaint with IC3 allows the FBI to identify patterns to aid federal investigations and public awareness efforts. Annual IC3 reports can be found at https://www.ic3.gov/Home/AnnualReports.

Sources:

Patrick J. Kiger and Sari Harrar, et al. “14 Top Scams to Watch out for in 2023.” AARP, www.aarp.org/money/scams-fraud/info-2023/top-scammer-tactics-2023.html. Accessed 23 June 2023.

Ritchie, John Newman & Amy, et al. “Romance Scammers’ Favorite Lies Exposed.” Federal Trade Commission, 24 Mar. 2023, www.ftc.gov/news-events/data-visualizations/data-spotlight/2023/02/romance-scammers-favorite-lies-exposed

“Romance Scams.” FBI, 25 Mar. 2020, www.fbi.gov/how-we-can-help-you/safety-resources/scams-and-safety/common-scams-and-crimes/romance-scams

Staples, Ana. “These Are 5 Scams to Watch out for in 2023, According to a Consumer Protection Expert.” CNBC, 4 Feb. 2023, http://www.cnbc.com/select/financial-scams-how-to-avoid/

Warford Videll, Amanda. “Romance Scammers Targeting Victims with Fake Crypto Investments.” FBI, 13 Feb. 2023, www.fbi.gov/contact-us/field-offices/jacksonville/news/romance-scammers-targeting-victims-with-fake-crypto-investments